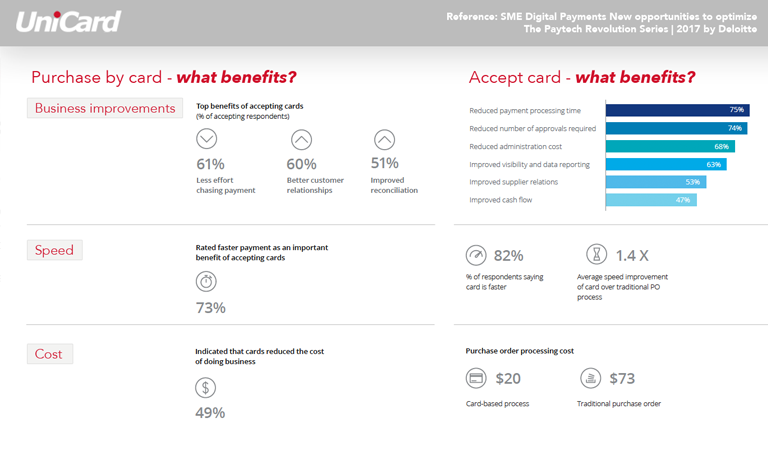

Credit card and debit card has no longer been the B2C-only payment methods. In 2015, Deloitte conducted a broad survey of business across Australia and New Zealand. The survey report showed that choosing an appropriate digital and card-based pay-in / payout solution indeed could bring some major benefits to businesses, including automating procedure, shorten operating time, reducing errors and improving customer experience.

According to the report, the biggest benefit of using card-based and digital payment means might be the reduction of “hidden” cost beyond transaction, such as time and staff capacity.

How do be truly benefited from implementing card-based B2B payment?

Using card-based B2B payment means may save you a lot of time and effort, but in order to maximize its advantages, you have to carefully consider which payment mechanism matches your business needs, payment operation and expenditure behavior the most; you need to compare thoroughly the cost with the expected benefits as to ensure you are getting benefits with a reasonable price. Before launching the payment means, you also need to communicate with your payers / payees to formulate the most convenient and quickest payment procedures.

Reference: SME Digital Payments New opportunities to optimize The Paytech Revolution Series | 2017 by Deloitte

B2B Payments 2015 Australia and New Zealand research Making credit card payments

UniCard